.png)

In today's modern days where transactions and communications occur on the internet, the security and reliability of our personal data becomes a point of concern, while this information is stored on centralized servers and government identity / immigration departments where data bleaches are likely to occur combined with limited applicability.

Identity monitoring and validation of information to be able to access the reputation and credibility of information normally centralized organizations, this has an impact on the consumers who face huddles when verifying their credit scores on various credit departments human verification. Its estimated that the centralized databases control almost 90% of our credit information which has a limitation when it comes to verifying our credit scores.

This centralized organization dictates who has access to the information and controls our financial services, meaning that for you to access financial services such as loan processing, you have to get your information despite maintaining your credit scores.

Traditionally the process of credit scoring has challenges in applicability, due to the centralized nature of accessing and collecting data from the community the majority of individuals are left untapped. This implies that we cannot get 3.5 billion people whose financial details are unknown because they are unbanked.

One of the projects revolutionizing the credit scoring of the decentralized community is KOALA, by boosting collective and collaborative use of a decentralized community, which will be able to get their information onto the internet without financial risks through blockchain technology that has proven to be immutable and secure way of storing private and confidential information's.

KOALA LIFE Dapp.

.png)

The Gap Gap bridges between the community and technology, where the blockchain technology data is encrypted in a distributed ledgers and management of user behaviors such as credit scores and artificial intelligence.

KOALA: DATA MINING.

.png)

Through the coalition of data mining users will be able to maintain their behaviors online where they can repay loans through assessments of their credit scores stored in immutable databases. This can help financial institutions automatically through an optimized identity and credit score verification.

Traditionally the unbanked community remains rich with untapped data, using blockchain technology we can be able to include millions of individuals who don't benefit from financial services because of limited credit score information.

KOALA: CREDIT BORROWING.

.png)

Through the use of modern technology, the people will be able to tap the unbanked communities, who will be able to access decentralized financial services and their credit scores maintained by a decentralized Koala platform and allow them to have access to their financial information.

The Koala platform which is powered by Blockchain technology can allow unbanked communities to have access to financial services by allowing them to have financial records stored in immutable records where they can be able to build their credit scores in order to access micro loans and peer to peer financial services. .

KOALA: FINANCIAL SERVICES.

.png)

The coalition platform will provide tools that empower the decentralized community by using blockchain and artificial intelligence in orders to learn, evaluate and maintain credit scores based on user activity on the blockchain. This process will allow financial processes to be transacted in a trustless, decentralized environment where financial records are stored on immobilized ledgers that will facilitate peer to peer financial services.

KOALA: QUIZ GAME

.png)

The Koala Tokens (KALC) on the platform game that will be processed in a transparent manner, users can use this token to use them when paying for services on the platform and also use them to processes information through the smart contract.

KOALA: MARRIAGE AND DATING

.png)

Users will be able to find their identities and information on the blockchain when dealing with dating services, the information will help you fake out using fake identities. The data stored and maintained by the users will be able to verify their behavior and characteristics without risking identity data. Bleaches, users have to agree on the use of information to trusted individuals.

KOALA'S LIFE ICO

- Start ICO September 03 2018

- ICO End 15 October 2018

.png)

.png)

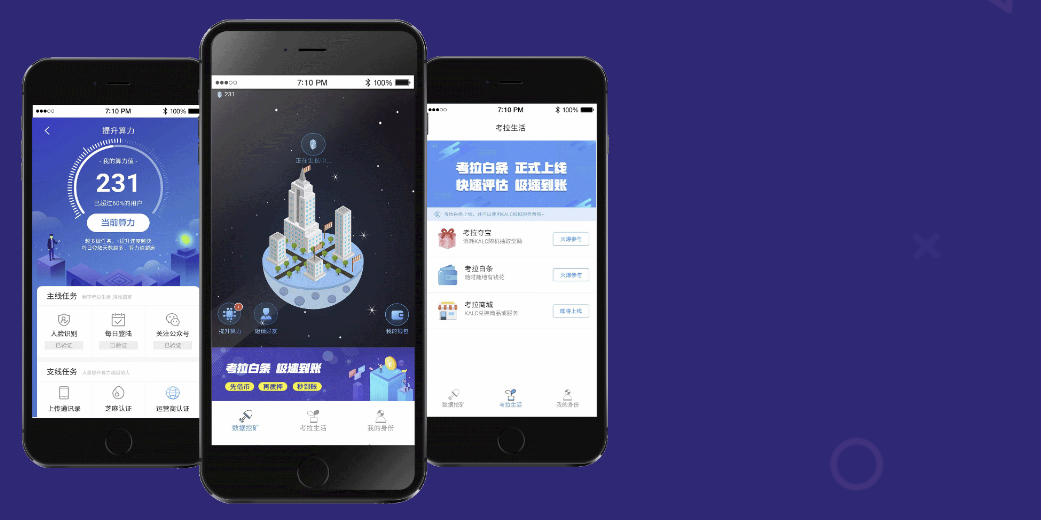

Mobile application coalition, which is compatible with your device and you can download Android App Koala here iOS APP here for more information on projects ICO, and more details on services provides by Koal Please check out the platforms websites, whitepaper and social media pages below.

References

- Web site: http://kalc.io/

- Technical documentation: http://kalc.io/index1.html#whitepaper

- Telegram: https://t.me/kalcofficialgroup

- Facebook: https://www.facebook.com/KALC-217367935631867

- Twitter: https://www.twitter.com/KALCofficial

- Medium: https://medium.com/@KALCofficial

- Reddit: https://www.reddit.com/user/KALCofficial

Author:dhavid19

Bitcointalk Profile Link:https://bitcointalk.org/index.php?action=profile;u=1795848

Eth Address:0x2e0aE95a7871c8A38A513981904410d07DD96231

No comments:

Post a Comment