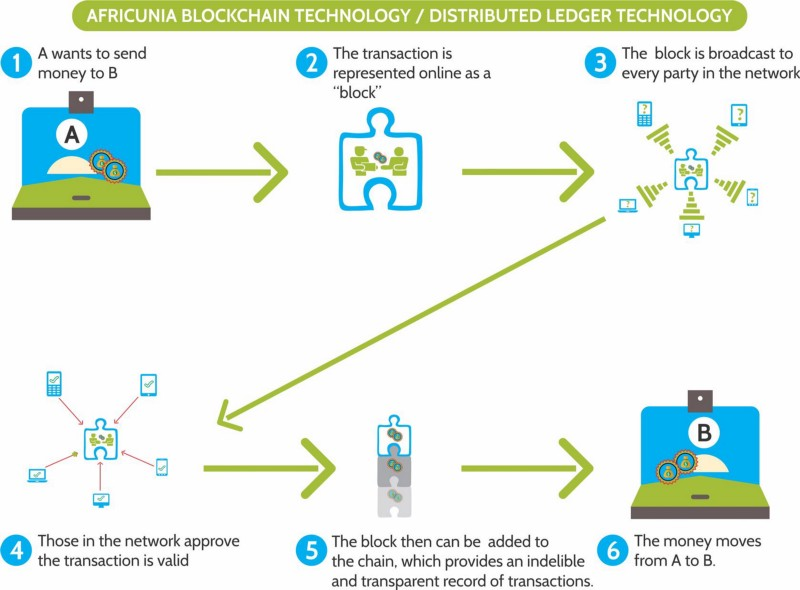

AFRICUNIA introduces an innovative banking model that enables the use of digital currencies without barriers, risks and technical barriers associated with the ownership, transfer and trading of cryptocurrencies and tokens.

About Africunia

AFRICUNIA plans to scale to deliver traditional and emerging banking products in a technology-driven era of the blockchain era and eventually become the single point of contact for all banking needs.

AFRICUNIA is in the process of implementing AFCASH, an encryption based on the AFRICUNIA Protocol Consensus Algorithm (APCA), to address the current issues of correctness, consensus, and benefits that the current protocols have partially resolved. Our main goal is to develop a new standard for tokenized investment that will serve as a catalyst to bridge the gap between Fiat and cryptocurrencies.

We offer a vision for the new standard of tokenized investment vehicles that will help bridge the gap between conventional and crypto universes. In particular, the AFCASH platform will be the one-stop shop solution for asset managers who want to create and manage token-based funds. In essence, AFRICUNIA will take advantage of the ubiquitous blockchain technology in the world of traditional equipment. If you've ever had any doubts about using Blockchain's classic investment technology, then the AFCASH from AFRICUNIA is your solution. It covers all aspects of tokenized investment vehicles ranging from technology to infrastructure to legal compliance to create a "responsible cryptocurrency".

You envision a bank that offers the best financial and investment services to anyone without restrictions, where you can securely store and manage your crypto assets, and where you can make secure and fast transactions and exchanges. It is now here - your bank and financial marketplace - AFRICUNIA.

AFRICUNIA sets a global goal - to reduce the gap between phiath and cryptocurrencies. The team expects AFRICUNIA to become the first African crypto bank. Why African? The answer is simple - it is this region that is technically and economically dependent on the whole world. A very large percentage of the population of African countries has never addressed the bank in their lives and even more bank accounts. The reasons are often the difficult availability of this type of service to citizens. AFRICUNIA will allow African residents to enjoy the full range of banking services and a little more. Not only does AFRICUNIA want to create an account or transfer money to another user, but also take advantage of the great benefits of blocking technology.

Details Marker ICO

- Sign AFCASH

- Price 1 AFCASH = 1 USD

- Platform ether

- Accept BTC, ETH, XRP, LTC, MIOTA, NARIA, Miscellaneous, Fiat

- Soft cap 2,000,000 USD

- Hard cap 50,000,000 USD

- Country United Kingdom

- White List / KYC KYC

milestones

1

- Research and experiment

- Exploring and experimenting with the RPCA will be our first step on the

- AFRICUNIA trip. Our developers become dummy prototypes of the

- Develop blockchain system based on APCA and on correctness, compliance and

- Check benefit. We are already exploring and experimenting with the APCA and its

- Application in blockchain; and it's live in advance.

2

- Pre-ICO

- The AFCASH pre-order will be opened on 1 December 2017 and runs until

- as of 31 December 2017 for 4 weeks. We aim for 500,000,000 tokens.

3

- ICO

- The AFCASH ICO starts on 1 January 2018 and runs until 31.

- March 2018 for 3 months.

4

- Development of blockchain prototypes

- At this stage, we will develop a blockchain prototype that will help

- Eliminate ambiguity and increase accuracy with our AFCASH crypto. It is advanced stage

- development.

5

- Development of the Blockchain beta version

- A beta version of our AFCASH crypto is being developed to help developers

- to better understand the ecosystem as more ambiguities are eliminated. We expect that

- this phase lasts for a maximum of 4 weeks. Therefore this phase runs from 1.

- April 2018 until April 30, 2018.

6

- Testing prototypes, beta version and the entire ecosystem

- We will test the system as a whole and make sure that it works properly and

- is interoperable with existing systems. This stage lasts a maximum of 3 weeks

- and runs from 1.

- May 2018 until May 21, 2018.

CONSULTANT

- Attorney Miletus MO Nlemedim Attorney / Legal Advisor LinkedIn

- Vasyl Pavlovich Financial Advisor LinkedIn

- Michael W. Büchi Financial & Diplomatic Consultant LinkedIn

- Nesto Boccovi Financial Advisor LinkedIn

- Gregor Novak Technological Consultant LinkedIn

- Karl Hartmann Technology Consultant LinkedIn

TEAM

- Chancellor Nzenwa Founder and President LinkedIn

- Madeleine Winkler Corporate Secretary LinkedIn

- Gérald Tissiere Chief Technology Officer (CTO) LinkedIn

- Irina Yuhanyuk Marketing Manager LinkedIn

- Dieter Frank Wipf Director of Marketing and Business Development LinkedIn

- Christian Abomo Operations Director , West and Central Africa LinkedIn

- Tetiana Liulka Social Media Director LinkedIn

- Oksana Sokolovska LinkedIn

- Sina Ickler Coordinator, Languages and Translations LinkedIn

- Christian Bogdan Blockchain Developer LinkedIn

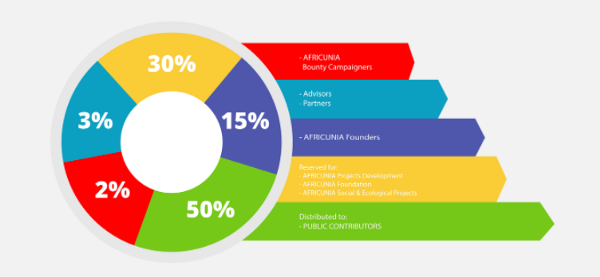

Total Sales: At the end of each fiscal year, 20% of African bank profits will be distributed among all holders of our tokens (afcash) based on the share of each owner of the total number of issued tokens, and it will automatically coin to our members in their purses to pay. In other words, you are entitled to income from Africa. Consider this as a passive income.

To learn more about AFRICUNIA, you can visit some of the following official sites:

Website: https://africunia.com/

Facebook: https://www.facebook.com/africunia

Twitter: https://www.twitter.com/africunia

the linked: https://www.linkedin.com/company / Bank-africunia

Telegram: https://t.me/africunia

Slack: https://africuniabank.slack.com

Medium: https://medium.com/@africunia

Instagram: https://www.instagram.com/ africunia

Facebook: https://www.facebook.com/africunia

Twitter: https://www.twitter.com/africunia

the linked: https://www.linkedin.com/company / Bank-africunia

Telegram: https://t.me/africunia

Slack: https://africuniabank.slack.com

Medium: https://medium.com/@africunia

Instagram: https://www.instagram.com/ africunia

AUTHOR:DHAVID19

BITCOINTALK PROFILE LINK:https://bitcointalk.org/index.php?action=profile;u=1795848

0X2E0AE95A7871C8A38A513981904410D07DD96231

No comments:

Post a Comment