Change is inevitable. In whatever path we chose to walk, we always have to be prepared for the changes that we will be forced to make ahead. We may not foresee the changes as they come but we have to adapt. The world is experiencing a change that we had not foreseen, maybe a few of us did, and we need to react in the right way to accommodate and adapt to its demands. Cryptocurrencies have gained an enormous amount of popularity and more people are adopting its use. What people are realizing however is that its everyday use is quite different from fiat currency. Cryptocurrency use has not been fully integrated by most outlets. You may have cryptocurrencies worth millions but unable to use them which just makes them useless. Using cryptocurrency then becomes tedious as they need to be converted to fiat most of the time. There are few institutions that offer these services adding more inconveniences to cryptocurrency owners. However, we are also changing and adapting. There are ways we could use existing technology to offer services that will not discriminate fiat or cryptocurrency but will provide a platform where both are interchangeable and can be stored in the same place. Blockchain brought about the popularity of cryptocurrency and it is the same technology that will solve the issues between fiat and cryptocurrency.

Forty Seven Bank is coming up to help us move away from outdated system by integrating them with newer technologies to meet the financial needs of clients which are becoming more complex by the day. Forty Seven Bank is a new innovative start up that is aiming to provide secure, diverse and appropriate banking services for the complex financial needs of the market for both individuals and institutions. It will offer these services in a manner that will be recognized by the governing bodies in its country(s) of operation. It will seek licenses of operation from the concerned bodies to obtain this recognition. Its main focus will be on digital finance as this is the only applicable way of accommodating both fiat and cryptocurrency in the same platform. It will offer unique features in the banking sector that will make it stand high above the rest. Forty Seven Bank is strategically incorporated in the United Kingdom as the governing bodies there are receptive to the innovations that can come from accommodating digital assets.

Forty Seven Bank is occupying a niche that has not been previously explored. They will therefore be the initiators of this market space hence having no competition at all. This will give them the advantage growing their customer base therefore providing services with the advantage of economies of scale. They can therefore charge even less amounts to facilitate transactions and other services as they will have the numbers to support their platform. The fact that Forty Seven Bank will be legally recognized will also increase their popularity as legal recognition offers some form of assurance that indeed Forty Seven Bank is a legitimate service provider having their subscriber’s needs at heart.

Transparency, innovation and customer satisfaction are just some of the characteristics that will be associated with Forty Seven Bank. Its platform will enable it to serve clients of different categories. From individuals to business institutions, all will find Forty Seven Bank meeting their needs. For the private client, there are features tailored to suit their needs. Security is obviously the first priority, for any banking institution or any institution for that matter. There have been methods that have been used previously for authentication of private clients but none has been as effective as biometric systems. Finger print readers, iris scanners, voice recognition are just some of the technologies that will be employed to verify the identity of private clients. Convenience follows right after security.

The Forty Seven Bank will have a unique account management system. These accounts will link fiat and cryptocurrency storage facilities and integrate then in the Forty Seven Bank account. These accounts will be known as ‘Multi-Asset accounts’. Forty Seven Bank will provide an application that will enable their clients to manage all their accounts from one place. In addition to providing this service, Forty Seven Bank will go a step further and provide exchange services in this application. Forty Seven will act as a cryptocurrency gateway by providing this service. The hassle of always looking for an exchange to transfer cryptocurrency to fiat or vice versa will be done away with by this platform. This exchange service will be so simple requiring only a few taps on a smartphone. This exchange will be available at all times for the Forty Seven Bank subscribe. This exchange will go beyond just cryptocurrency and fiat, it will also include exchanges between fiat and fiat and cryptocurrency with another cryptocurrency. Multi asset banking is also set to reduce transactional costs in the platform. Having all transactions being executed from one point will make transactions cheaper and more convenient in Forty Seven Bank. Price-stable cryptocurrencies will also be provided by Forty Seven Bank. The fluctuation of the value of cryptocurrencies in fiat, as we have already seen, may be a problem when converting from cryptocurrency to fiat. Through this service, Forty Seven Bank will have created a convenient program where purchases and exchanges can be made without any fear of losing value when executing transactions.

To support Multi-Asset accounts, Forty Seven Bank will provide cryptocurrency wallets in their platform. This wallet will be able to hold a number of cryptocurrencies. Forty Seven will partner with other public blockchains to allow them to access their cryptocurrencies in their own platform. These wallets will only be accessed through private keys that will be issued by Forty Seven. They will be stored securely in private a private blockchain. The platform will also allow their users to access their bank accounts from any area in the globe by simply using their private key.

In terms of security, the Forty Seven Bank will ensure that no criminal activities are taking place through their platform. Forty Seven Bank will have a good relationship with the authorities in terms of having the right documents and having members that are not associated with any money laundering activities. Know your client (KYC) and Anti-Money laundering (AML) requirements will have to be met by anyone client who wants to bank with Forty Seven Bank. Forty Seven Bank will blacklist anyone who shows criminal intent within the platform. They will conduct their investigations before black listing accounts and publishing them publicly in their blockchain for all their clients to see.

Apart from these unique services, Forty Seven Bank will also offer the basic services banks do; services such as giving out loans to their clients. In as much as this is a basic service, Forty Seven Bank will make it special by offering cryptocurrency loans to their clients. This will be a first in the financial world as no institution offers such services. Forty Seven Bank will also ATM services as normal banks do that will work together with their cryptocurrency gateway to make it convenient for their clients to withdraw fiat currency at these ATM points.

With regards to business, Forty Seven Bank will provide excellent services and solutions that will help businesses bridge the gap between their cryptocurrency operations and their fiat operations. The number of people using cryptocurrencies in increasing and many may want to use their cryptocurrencies to purchase products and services. Forty Seven Banks will make it possible for businesses to receive payments from fiat or cryptocurrencies. They will convert either currency to whatever the bank desires, Forty Seven Bank will have opened up new opportunities for business through this service. E-commerce platforms will especially find this useful as cryptocurrency is mostly used in the digital world. They will also receive services that will allow them to easily receive payments from their websites directly to their Forty Seven Bank account in whatever format they select. These services will be provided for through the cryptocurrency payment system that Forty Seven Bank will offer. Invoicing services will also be provided for e-commerce and other business. Since most operations involving transactions will be done through Forty Seven, frictional costs will drop thus reducing the operational costs of businesses.

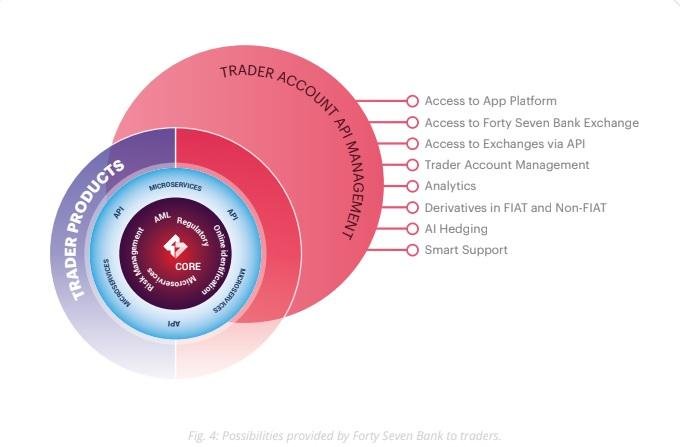

Forty seven Bank will go beyond businesses and private clients. It will also be a hub for developers to try out new business applications that will improve their banking system. This will help Forty Seven Bank remain relevant in this market space as they will always have innovative ideas through their development sector. Forty Seven Bank will also offer start-ups that want to test the banking sector a service whereby they can use Forty Seven as their ‘own’ bank. Through this, they will be able to develop their brand through activities such as marketing as Forty Seven deals with the banking issues.

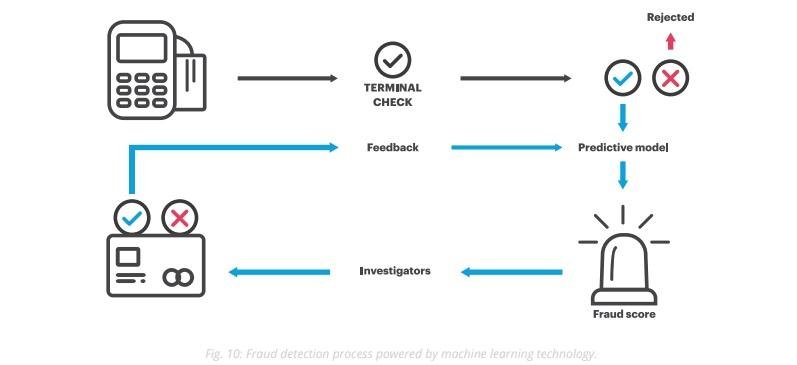

On top of all these, Forty Seven will employ machine learning in their platform. This will allow them to offer services such as consulting for their clients who would want to invest in cryptocurrencies or any other market investments. The machine learning system will analyze the product these clients wish to invest in and track what affects their value both directly and indirectly and predict their possible value in future. Apart from this, machine learning will also be essential in detecting fraudulent activities in the Forty Seven Bank platform. The scope of machine learning will also extend to determine potentially new markets, coming up with customer needs from transactions taking place in the bank and even forming the basis of development of new products through its analytic system.

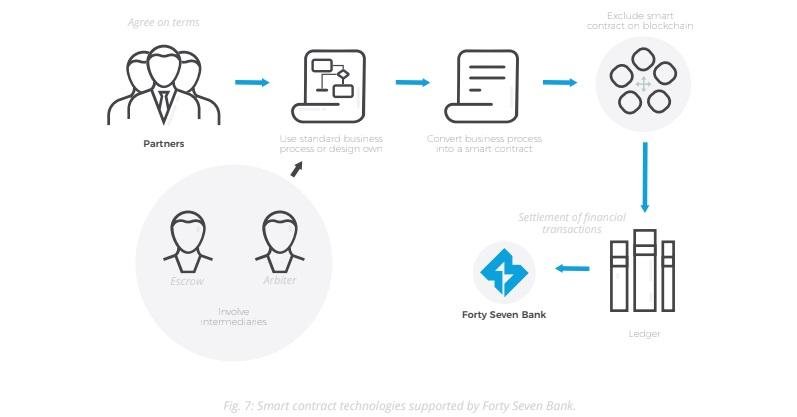

Smart contracts will be essential in providing the services mentioned. They will help in nearly all products that Forty Seven will offer. Cryptobonds and cryptofutures which will be lucrative for traders in the Forty-Seven platform will be made possible through smart contracts. They will also control the exchange services that will be offered by Forty Seven. Forty Seven will make these smart contracts legally binding for security reasons. This will create trust between trading partners in the platform and give users a sense of security as they will be assured that they can take legal action in-case of any infringement of their rights. Since Forty Seven aims to be registered as a financial institution, they will have to abide by the rules and regulations of the governing bodies. This will include laws that prevent Forty Seven bank members form exploitation by Forty Seven or any other party in the bank. Smart contracts will also help Forty Seven provide Escrow services for businesses or any other party.

The banking sector is in need of change. With the current acceptance rate of cryptocurrencies, traditional banking systems will have to rethink their strategies and come up with services that will accommodate cryptocurrency clients. By the time they do this however, Forty Seven Bank will have already made such huge strides in this market space. The fact that Forty Seven is based on blockchain will also put it at an advantage as they will provide token services that traditional banks cannot.

Through their tokens, known as FSBT (Forty Seven Bank Tokens), holders will be able to access loyalty programs provided by Forty Seven Bank and even win goods and services each year. It will also be necessary for developers to own FSBT in order to access certain services in the Forty Seven Bank platform. The FSBT will also be used for trading which means that Forty Seven clients will have a chance of gaining from the tokens. This trading will begin after the crowdsale is completed. The crowdsale ends on 30th March, 2018 and no sale will follow after. The soft cap targeted by Forty Seven has been surpassed which shows the success of the crowdsale. Forty Seven Bank has a detailed description of their plans for the banking sector which can be read via https://drive.google.com/open?id=0BzvESRkgX-uDeHc1QjRzbHRBelU. You can also read more on the token sale and advantages of the FSTB through https://drive.google.com/file/d/0BwDjfDDrGhcsLTJOYzd1ZkZ0WU0/view.

You can still participate in the crowdsale in order to enjoy the benefits of FSBT. This can be done through their official website and further social channels, which are all listed below.

Website- https://www.fortyseven.io/

Telegram- https://t.me/thefortyseven

Facebook- https://www.facebook.com/FortySevenBank/

Twitter- https://twitter.com/47foundation

Medium- https://medium.com/@fortyseven47

Reddit- https://www.reddit.com/r/FortySevenBank/

Bitcointalk Forum- https://bitcointalk.org/index.php?topic=2225492

Telegram- https://t.me/thefortyseven

Facebook- https://www.facebook.com/FortySevenBank/

Twitter- https://twitter.com/47foundation

Medium- https://medium.com/@fortyseven47

Reddit- https://www.reddit.com/r/FortySevenBank/

Bitcointalk Forum- https://bitcointalk.org/index.php?topic=2225492

Bitcointalk Profile:https://bitcointalk.org/index.php?action=profile;u=1795848

No comments:

Post a Comment