Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organizations; a bank that will correspond to all the requirements of regulators.

A team of professionals from the worlds of banking, finance, and IT with expertise and experience in the creation and licensing of payment systems, and building of electronic financial institutions will work to realize the goals of the project.

Our bank will become the biggest structure that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2). We will comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to guard against agents of the “grey” market.

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hi-tech bank.

It is also a global race, is going to modernize in different aspects of souk’s life it becomes the challenge, adept the challenge and tackle the challenges us among the overflowing of consumer wishes. The best challengeable sector’s is now going to be in all exclusive manners by the way of towering returns as well as the towering safety of the wellbeing. In global race of financial sectors to towering the returns in an effective plus boom in the efficient way numerous technologies will be used for the development. These racing technologies blow the colossal like the stars of the sky on the financial services. Due to this it becomes more demandable among the consumers of the financial sector. Every one desires the best outcomes of their product which they are procured. In the worldwide an individual and institutional consumer’s demands becomes more challengeable for entire financial sector. The best technology in the financial sectors turns in to the digital assets and tune up in the decentralized souk. The decentralized trend is bloom in the market. In the decentralized markets the PSD2 coming soon in the financial institution. By this the consumers will access their products as well as services to make their trade and transaction in the market of the digital assets by the APIs. To create the market potential, technological prospect has become the race among the financial sectors. One of the financial institution, Forty Seven bank can build the secure transactions among the digital finance as well as financial system. In the financial institution the Forty Seven Bank is fully digital innovative branchless. Forty Seven Bank is fabricate the overpass sandwiched between the world of the cryprocurrency as well as habitual financial system. The Forty Seven Bank on one roof bond the user’s populace of digital asset with supplementary traditionalist folks. In the Forty Seven Bank an innovative financial technology can be used. The Forty Seven Bank is entirely secure, consumer forthcoming banking services as well as towering eminence and quality. By this the Forty Seven Bank becomes the eye catching among user in the souk of financial institutions. The Forty-Seven is lying on the API supervision, Blockchain technology, bio-metrics, smart contracts, machine learning, adaptive security plus cloud computing. This craft the forty-Seven customer possessor take pleasure in faithfulness grows resting on a annually root as well as also benefit from the elastic life for haulage elsewhere steadfast dealings by way of forty-Seven banking institution all through an allied globe of block nodes as well as valid point in time financial platforms. https://www.fortyseven.io/

THE MISSION OF FORTY SEVEN BANK

We strongly believed that PSD2 directive will come in full force in year 2018. Forty Seven Bank system will also develop in accordance to upcoming regulatory framework in early stage. It will be forty seven advantages in terms of cost.

OUR VALUES ARE:

- Transparency;

- Financial stability;

- Effectiveness and user friendly procedures;

- Security and privacy (data protection);

- Innovativeness;

- Customer satisfaction;

- Market share growth and worldwide expansion;

- Profit for all stakeholders

PROPOSITIONS FOR BUSINESS

Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving payments from a merchant in both cryptocurrencies and in fiat money on the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring services based on the operation of machine learning and big data (artificially intelligent algorithms able to predict the probability of repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions

THE INNOVATIVE PRODUCTS

The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorization based on passport and biometric data

- Unique combination of payment tools — SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions with any type of cryptocurrency through the bank’s application and with no need to wait for current exchanges. Uploading, withdrawal, and conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis that helps a client to make the right financial decisions via services of a personal manager created on the basis of machine learning algorithms

TOKEN DETAILS

· The ICO begins on October and ends by December 11, 2017.

· Pre-ICO starts by 30thg October, 2017 (15:00,

· Pre — ICO will ends by November 6, 2017

· The main ICO begins on November 13, 2017 and ends by 11th December, 2017

· ETH is accepted on the Pre-ICO while ETH and BTC will be accepted during the main ICO. Minimum budget to start the project is 5,000,000.00 EUR (18,000 ETH). The fixed rate for one token is 000047ETH.

· Don’t miss, hurry up and join the ICO. Forty seven bank platform is will developed technologically with blockchain technology, biometrics, smart contracts and sophisticated machines to as to enable perfect financial security and faster transactions . Forty seven started since October 2016 to lay their plans of expanding the notion of a modern bank that which will work together with cryptographic currencies and also fiat money

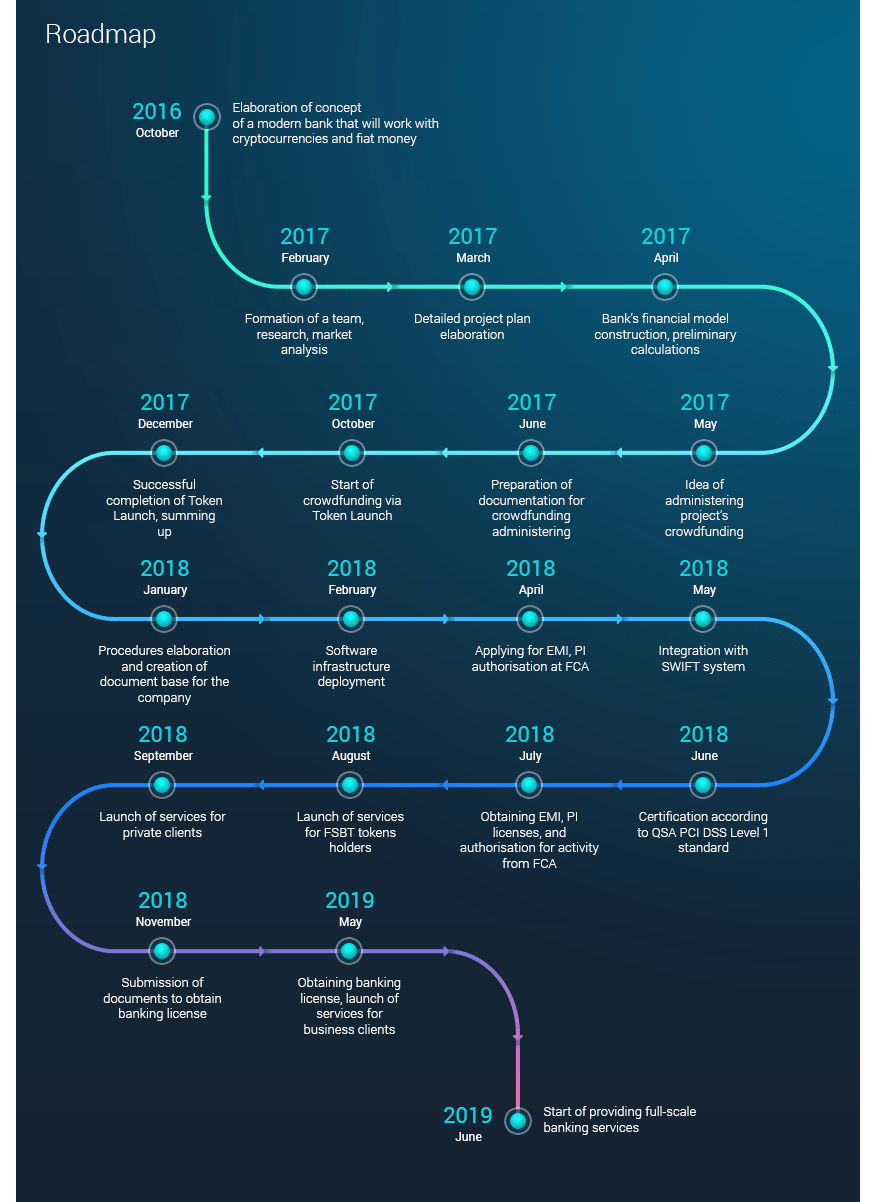

ROADMAP FORTY SEVEN BANK

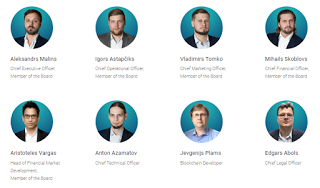

FORTY SEVEN BANK TEAM

· Further Visits

· Website : https://www.fortyseven.io/

· Whitepaper : Click here for Whitepaper

· Telegram : https://t.me/thefortyseven

· Twitter : https://twitter.com/47foundation

· FaceBook : https://www.facebook.com/FortySevenBank/

· Bitcointalk ANN : https://bitcointalk.org/index.php?topic=2225492

Blog Created by

dhavid19

· Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1795848

Ethereum Wallet : 0x2e0aE95a7871c8A38A513981904410d07DD96231

No comments:

Post a Comment